This 2-Min Video Shows Why >95% of Construction Firms are Qualified for R&D Credits

Our Average Construction Client Recovers $65,000 in Overpaid Taxes.

To Get Your Overpaid Taxes Back, Take the 2-Minute Survey Below to See if You Qualify

Important Distinction: Don't delay taking the survey because R&D Credits are separate from Employee Retention Tax Credits (ERTC).

Reclaiming Your Overpaid Taxes is a Retroactive Recovery Through Multiple Checks

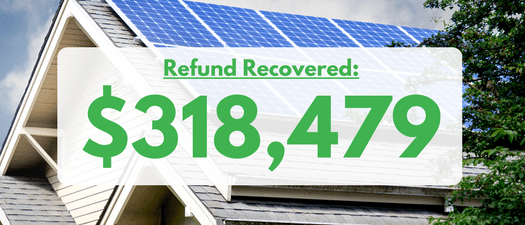

Years processed: 2017, 2018, 2019

Location: San Luis Obispo, CA

Employees: 35

Entity type: S Corp

Activities:

- Custom green builder

- Solar tubes/skylights

- Tile roofs (clay and concrete)

- TESLA roofs

Refund Recovery: $318,479

Years processed: 2017, 2018, 2019

Location: Hawaiian Gardens, CA

Employees: 21

Entity type: S Corp

Activities:

- Framing and wood structures contractor

- Both for commercial and residential projects

Refund Recovery: $53,550

Years processed: 2017, 2018

Location: Fresno, CA

Employees: 28

Entity type: S Corp

Activities:

- Specializing in agriculture, uses TELCO/data

- Deep well drilling and irrigation and overhead and underground electric meter service

- Cellular site electrical grounding systems and emergency standby systems

Refund Recovery: $70,303

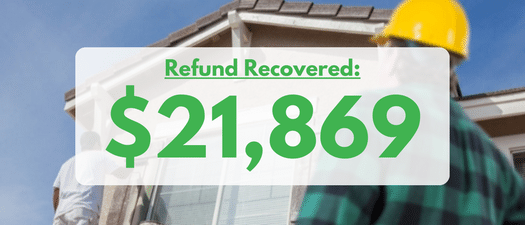

Years processed: 2017, 2018, 2019

Location: Irvine, CA

Employees: 11

Entity type: S Corp

Activities:

- Commercial and residential painting contractor specializing in

- Wire brushing and sanding

- Airless spray and brush and roll

Refund Recovery: $21,869

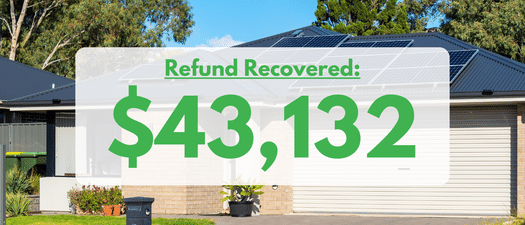

Years processed: 2018, 2019

Location: Concord, CA

Employees: 6

Entity type: S Corp

Activities:

- Commercial and residential roofing contractor

- Specializing in the GAF Roof system

Refund Recovery: $43,132

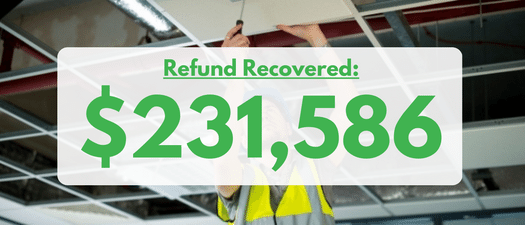

Years processed: 2017, 2018, 2019

Location: Ceres, CA

Employees: 14

Entity type: S Corp

Activities:

- Design, and build custom electrical systems

- New construction and automated systems

Refund Recovery: $231,586

Why Do Most Construction Companies Miss Out on This Major Tax Break?

Source:https://www.forbes.com/sites/deanzerbe/2013/03/28/eight-myths-that-keep-small-businesses-

from-claiming-the-rd-tax-credit/?sh=4cd3511c2944

Source: INC. - Two Tax Credits Many Small-Business

Owners Miss -- or Don't Know About

Frequently Asked Questions About R&D Credits and Incentives

This sounds too good to be true, doesn't it?

No. U.S. companies have been taking advantage of these credits for decades. With the recent changes (PATH ACT in 2015), more small to medium-sized businesses are starting to claim these credits. But even with the increase in claims, less than 5% of companies that qualify for the R&D Tax Credit are taking the time to do so. For dental practices, this number is even smaller: only 2% take advantage of this program although we’ve found that 98% qualify.

Is this worth my time?

Absolutely. Since the changes in legislation and tax reform, the R&D Tax Credit remains one of the most valuable incentives offered by the U.S. government for businesses to remain competitive.

Why does the government offer the R&D Tax Credit?

To encourage companies within the U.S. to keep technical talent domestic while simultaneously continuing to drive innovation. This helps make your company competitive domestically and our country competitive globally. A win-win scenario for everyone.

I have a CPA, why haven’t I heard of this?

It’s a very specific and niche credit CPAs are typically not trained on. More than $16 billion in federal tax credit benefits alone are given out annually, and a tiny percentage is recovered each year, and CPAs do almost none of it. It’s very time-consuming, takes years of training, and is typically not something they are even familiar with.

Can the R&D credit be claimed for a prior year?

Yes, if the amended return is filed within three years of the original filing date.

What expenses qualify for the R&D Credit?

Qualified research expenses include employee wages, material expenses, and contracted labor costs.